Houses for Sale: A Simple Guide to Finding Your Dream Home

Buying a house for sale is a big deal it’s often the largest purchase you’ll make in your life. While it can be exciting, it can also feel overwhelming, especially if it’s your first time. This guide breaks down the process of buying a house into easy-to-understand steps to help you find the perfect home.

1. Know What You Want

Before you start looking for houses, take some time to think about what you really need. Here are some important things to consider:

A. Set a Budget

Figure out how much you can afford. This includes not just the price of the house but also costs like property taxes, insurance, and maintenance. Getting pre-approved for a mortgage can give you a clearer idea of your budget.

B. Choose a Location

Think about where you want to live. Do you need to be close to work, schools, or public transport? Research different neighborhoods to find one that feels right for you.

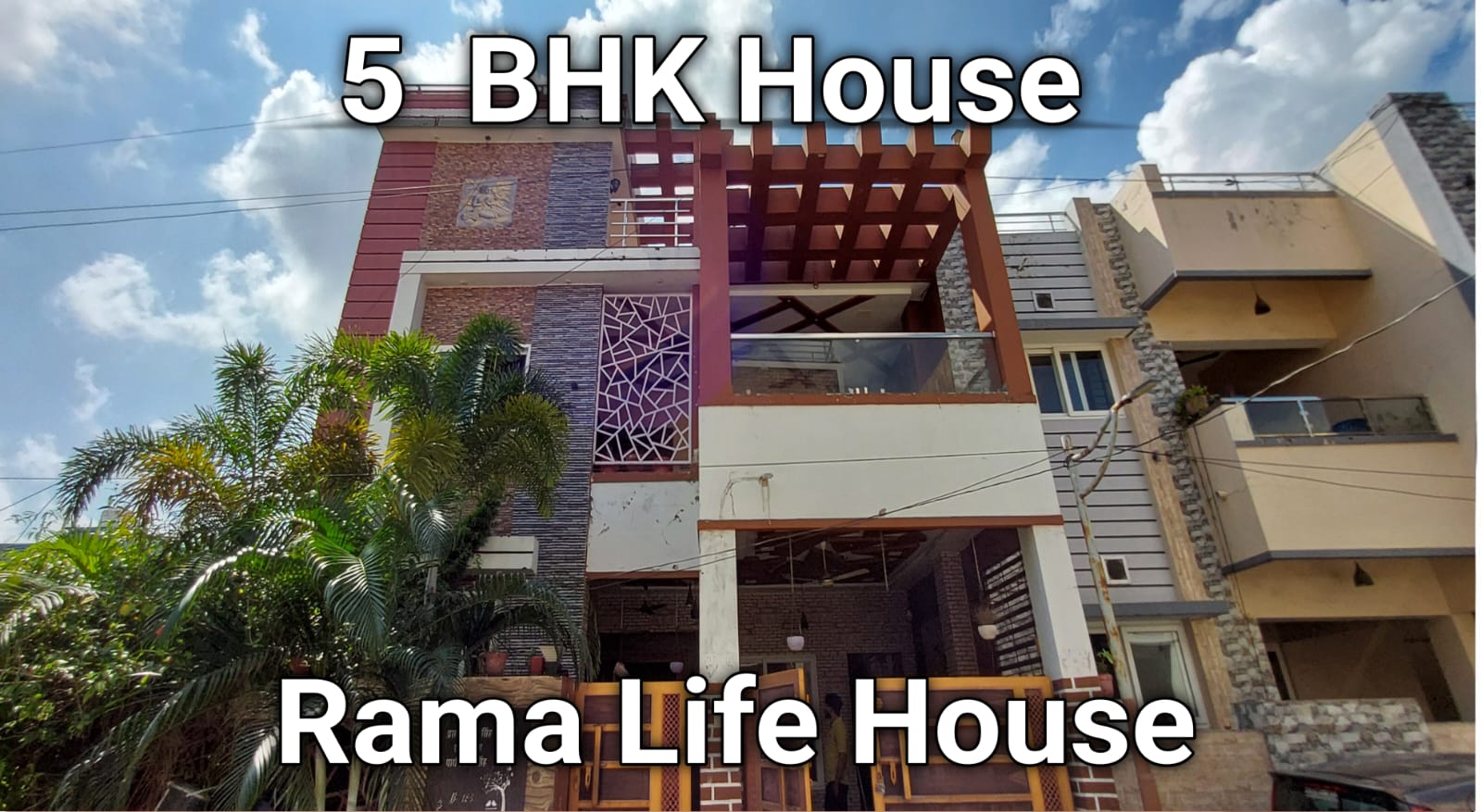

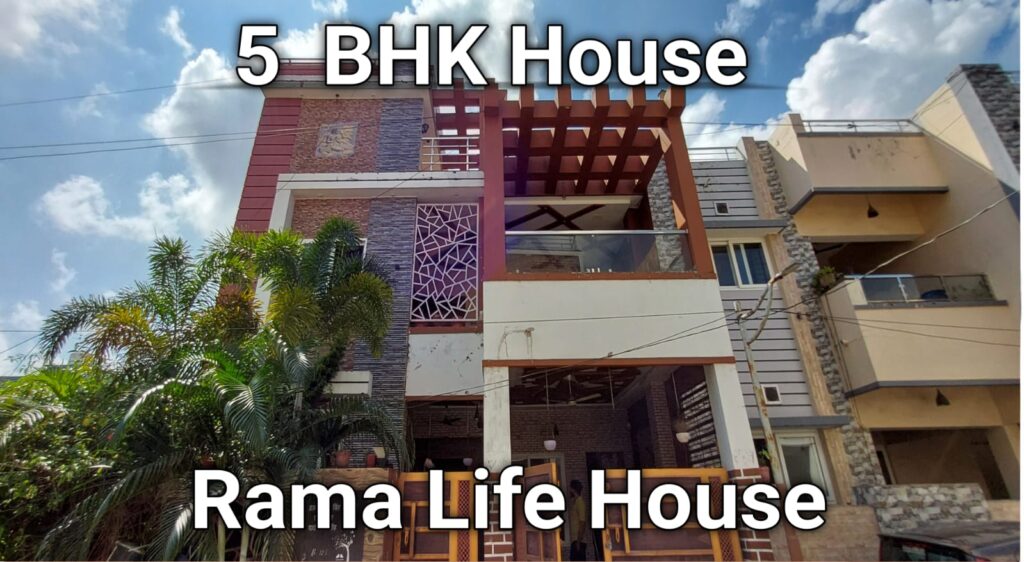

C. Decide on Size and Layout| House for sale

How many bedrooms and bathrooms do you need? Would you prefer an open layout or separate rooms? Make a list of your must-haves to narrow down your options.

D. Consider the Future

Think about your long-term plans. Are you starting a family or planning to retire soon? Make sure the house you choose can meet your future needs.

2. The Home-Buying Steps

Once you know what you want, you can begin the home-buying process. Here’s how to go about it:

A. Find a Real Estate Agent

A good agent can help you navigate the market. They know the neighborhoods, have access to listings, and can negotiate on your behalf. Look for someone you feel comfortable with.

B. Start Your Search

With your criteria in hand, begin looking for houses. Use online real estate websites, attend open houses, and drive around neighborhoods that interest you.

C. Visit Homes

Once you have a list of potential homes, schedule visits. Pay attention to details like the condition of the roof, plumbing, and appliances. Don’t hesitate to ask questions about the home’s history.

D. Make an Offer

When you find a home you love, it’s time to make an offer. Your agent will help you draft a competitive offer based on recent sales in the area. Be ready for some back-and-forth negotiation.

E. Get a Home Inspection

After your offer is accepted, arrange for a home inspection. This is essential to identify any hidden issues, like structural problems or outdated systems. If issues arise, you may want to renegotiate the price or request repairs.

F. Close the Deal

Once everything checks out, you’ll go through the closing process. This involves signing paperwork and transferring funds to officially own the home. Congratulations! You’re now a homeowner.

3. Types of Houses to Consider

When searching for houses for sale, it’s helpful to know the different types of properties available. Here are a few options:

A. Single-Family Homes

These standalone houses are perfect for one family and usually offer more privacy and space, including yards.

B. Condominiums (Condos)

Condos are individual units in a larger building. They often come with shared amenities like pools and gyms, making them a low-maintenance option.

C. Townhouses

Townhouses are multi-story homes that share walls with neighbors. They strike a balance between space and maintenance ease, often featuring small outdoor areas.

D. Multi-Family Homes

These properties have multiple separate living units, making them great for investors. You can live in one unit and rent out the others for extra income.

E. Luxury Homes

If you have a larger budget, luxury homes offer high-end amenities and prime locations, often featuring pools and expansive living spaces.

4. Keeping Up with Market Trends

Being aware of market trends can help you make smart decisions. Here are some things to watch:

A. Housing Inventory

Pay attention to how many houses are for sale in your area. A low inventory can drive prices up, while a surplus may lead to more bargaining power as a buyer.

B. Pricing Trends

Research average home prices in your target neighborhoods to see if they are rising or falling.

C. Days on Market

This indicates how long homes stay on the market. Fewer days suggest a competitive market, while more days may mean buyers are hesitant.

5. Financing Your Home Purchase

Understanding your financing options is key. Here are some common choices:

A. Conventional Loans

These standard mortgages are not backed by the government. They usually require a higher credit score and down payment but come with flexible terms.

B. FHA Loans

Backed by the Federal Housing Administration, these loans are great for first-time buyers with lower credit scores and smaller down payments.

C. VA Loans

Available to veterans and active-duty military members, VA loans often require no down payment, making them a fantastic option.

D. USDA Loans

These loans are for rural homebuyers and require no down payment, targeting low- to moderate-income buyers in eligible areas.

6. Tips for First-Time Homebuyers

If you’re buying a home for the first time, keep these tips in mind:

A. Educate Yourself

Learn about the home-buying process. There are plenty of resources, including books and online courses, that can help you understand what to expect.

B. Be Patient

Finding the right home takes time. Don’t rush into a decision; wait for a property that feels like the right fit.

C. Stick to Your Budget

While it’s tempting to stretch your budget for a dream home, make sure you can comfortably afford the monthly payments and other costs.

D. Always Get an Inspection

Never skip the home inspection. It can reveal issues that may lead to unexpected repairs later.

7. Conclusion -House for sale

Buying a house is a big step, and being informed can help make the process easier and more enjoyable. By understanding your needs, navigating the buying process, and keeping an eye on market trends, you can find the perfect home for you. Whether you’re a first-time buyer or looking for an investment, there’s a house out there waiting for you. Embrace the journey to homeownership, and soon enough, you’ll be settled into a place that truly feels like home.